Stocks slumped on Tuesday as the risk-off mood intensified amid tech valuation worries and interest rate uncertainty.

“Investors around the world are transfixed by US tech, amid concerns that the sector could be grossly overvalued should future returns on investment fail to match current expectations,” noted David Morrison, senior market analyst at Trade Nation.

The FTSE 100 index closed down 123.13 points, 1.3%, at 9,552.30.

The FTSE 250 ended 263.09 points lower, 1.2%, at 21,424.81, and the AIM All-Share fell 9.98 points, 1.3%, at 734.47.

On the FTSE 100, falls were broad-based with banks a prominent weak feature as the Daily Telegraph newspaper reported the sector could be hit by a tax rise in next week’s Budget.

HSBC, Barclays, NatWest and Lloyds fell 3.4%, 2.7%, 2.3% and 1.9% respectively.

ICG led the risers, gaining 4.5%, as it reported European asset manager Amundi will take a near 10% stake in the firm, and it posted better-than-expected half-year results.

The London-based, private equity, investment firm said pre-tax profit at its Fund Management Co business rose 65% to £324.6 million in the six months to September 30 from £196.4 million the year prior, which Panmure Liberum said was ahead of the £263 million consensus.

Management fee income rose 16% to £333.6 million from £286.6 million. Assets under management increased 14% to 124.3 billion dollars (£94.6 billion) from 106.3 billion dollars (£80.9 billion).

In addition, ICG said Amundi will take a 9.9% stake in ICG as part of a long-term strategic partnership.

Founded in 2010, Amundi is the result of the merger between the asset management activities of Credit Agricole and Societe Generale.

Deutsche Bank thinks the deal signals, “ICG’s ambition to be a genuine global top tier player in the industry over the long term”.

“Whilst there are no financial targets outlined, we would view this as ICG having gained access to a potentially very valuable option, through the fund-raising potential in a largely new channel, whilst needing to commit limited incremental resource/investment,” the broker added.

In European equities on Tuesday, the CAC 40 in Paris slumped 1.9%, while the DAX 40 in Frankfurt tumbled 1.7%.

In New York, markets were lower at the time of the London equity market close.

The Dow Jones Industrial Average was down 1.1%, the S&P 500 index was 0.9% lower, and the Nasdaq Composite declined 1.3%.

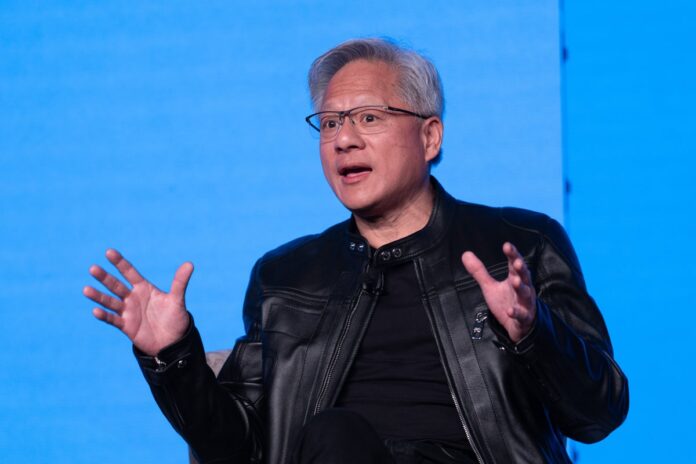

On Wall Street, the focus this week will be on Nvidia earnings on Wednesday and non-farm payrolls a day later.

Joshua Mahony, chief market analyst at Scope Markets, thinks this week looks to be “pivotal” for financial markets, with “recent concerns over the potential end to the AI trade meaning that we are expecting major volatility in the lead-up and response to tomorrow’s Nvidia earnings”.

“Coming after the close, this report will represent one of the biggest moments for markets in months. Anything but a perfect scorecard will likely exacerbate the current weakness evident in the sector, hammering home concerns that the AI boom has been artificially created through a series of inter-company deals rather than providing significant revenues from the end user,” he suggested.

Nvidia was down 2.6% on Tuesday around the time of the London close, while Microsoft fell 3.4%, Amazon 3.1% and Alphabet 2.7%.

Alphabet chief executive Sundar Pichai said while the growth of artificial intelligence investment had been an “extraordinary moment”, there was some “irrationality” in the current AI boom.

Speaking to the BBC, he said every company would be affected if the AI bubble was to burst.

The yield on the US 10-year Treasury was at 4.12%, trimmed from 4.13% on Monday. The yield on the US 30-year Treasury was at 4.74%, widened from 4.73%.

Adding to Wall Street’s woes were weak earnings from retailer Home Depot which lowered full-year guidance after reporting worse than expected third quarter earnings.

Home Depot shares fell 3.6%, with Walmart, which reports results on Thursday, down 0.7%.

Sterling was quoted at 1.3141 dollars at the time of the London equities close on Tuesday, lower compared to 1.3169 dollars on Monday.

The euro stood at 1.1576 dollars, lower against 1.1598 dollars. Against Japan’s yen, the dollar was trading higher at 155.44 Japanese yen, compared to 155.12 yen.

Back in London, Crest Nicholson plunged 13% after warning annual profit could land below guidance, as the housing market grapples with UK government budget uncertainty.

The housebuilder said adjusted pre-tax profit for the year ended October 31 is expected to be at “the low end of, or marginally below” a guidance range of £28 million to £38 million.

This reflects a “housing market that has remained subdued through the summer, and the continued uncertainty surrounding government tax policy ahead of the forthcoming budget,” the firm added.

Ocado plunged 16% after stating that three, robotic, customer fulfilment centres closures by trading partner Kroger will reduce fee revenue in financial 2026 by around 50 million dollars (£38 million).

The Hatfield, England-based, online grocery retailer launched a partnership with Kroger, one of the largest supermarket chains in the US, back in 2018.

The two companies had agreed to build the equivalent of 20 customer fulfilment centres. But Kroger announced on Tuesday that it will close three CFCs in Frederick, Pleasant Prairie and Groveland.

Ocado said it expects it will receive compensation for fees related to the early closure of these three sites of more than 250 million dollars (£190 million).

Brent oil was quoted lower at 64.10 dollars a barrel at the time of the London equities close on Tuesday, from 64.46 dollars late on Monday.

Gold traded lower at 4,060.07 dollars an ounce on Tuesday against 4,071.30 dollars on Monday.

The biggest risers on the FTSE 100 were: ICG, up 84.0 pence at 1,973.0p; Imperial Brands, up 76.0p at 3,229.0p; Tesco, up 3.6p at 441.1p; Diploma, up 30.0p at 5,290.0p; and Centrica, up 0.85p at 167.1p.

The biggest fallers on the FTSE 100 were: Melrose Industries, down 24.4p at 602.0p; Antofagasta, down 101.0p at 2,637.0p; 3i, down 123.0p at 3,276.0p; Convatec, down 8.6p at 230.6p; and HSBC, down 37.4p at 1,056.0p.

Wednesday’s global economic calendar has UK and eurozone inflation figures and minutes of the October Federal Reserve meeting.

Wednesday’s UK corporate calendar has half-year results from real estate investor British Land and full-year earnings from accountancy software provider Sage.

Contributed by Alliance News